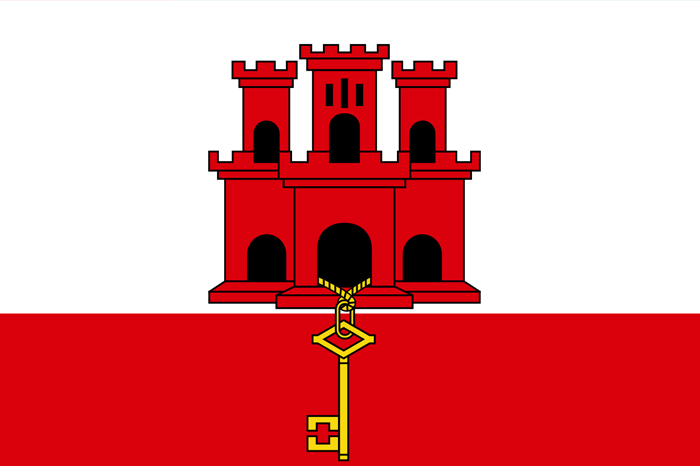

Gibraltar

- Gibraltar is a British Overseas Territory located on the southern end of the Iberian Peninsula on the Mediterranean sea. The economy is dominated amongst others by financial services, internet gaming, tourism and shipping. The corporate law is based on the United Kingdom 1929 Companies Act and the Companies Ordinance from 1984.

- A Gibraltar Non Resident Company is not liable to the tax system. A Gibraltar Non Resident Company does not fall under the Gibraltar tax system. In addition there is no wealth tax, Capital Gains Tax, gift tax or Value Added Tax.: There is no wealth tax, capital gains tax, gift tax or value added tax.

- All limited companies are required to file accounts, however balance sheet is permissible and there is no requirement for an audit or profit and loss accounts.

- Excellent corporation law

- Flexible company law

- Political and economic stability

- Excellent worldwide communication facilities

- Skilled personnel

- No capital gains, income or other kinds of taxes

GIBRALTAR OFFSHORE COMPANY FEATURES |

|

|---|---|

General |

|

| Type of Company | Non resident |

| Type of Law | Common |

| Shelf company availability | Yes |

| Our time to establish a new company | 5-8 days |

| Minimum government fees (excluding taxation) | £60 |

| Corporate Taxation | Nil |

| Double Taxation Treaty Access | No |

Share capital or equivalent |

|

| Standard currency | GBP |

| Permitted currencies | Any |

| Minimum paid up | £1 |

| Usual authorised | £2,000 |

Directors |

|

| Minimum number | One |

| Local required | No |

| Publicly accessible records | Yes |

| Location of meetings | Anywhere, except Gibraltar |

Shareholders |

|

| Minimum number | One |

| Publicly accessible records | Yes |

| Location of meetings | Anywhere, except Gibraltar |

Company Secretary |

|

| Required | Yes |

| Local or qualified | Yes |

Accounts |

|

| Annual Tax Return | Yes |

| Audit requirements | Yes, but small company exceptions |

| Requirements to file accounts | Yes |

| Publicly accessible accounts | No |

Other |

|

| Requirement to file annual return | Yes |

| Change in domicile permitted | Yes |